Financial Solutions

Financial Debt Solutions provide consumers with a way to permanently solve their debt issues and choose an affordable monthly payment. Golden Financial Services has assisted over 8-million consumers since 2004 with becoming debt free and achieving financial freedom. We can offer you a financial solution to help you become debt free in 12-48 months, depending on your goals and needs.

Your interest rates can be reduced with consumer credit counseling and eliminated when using a financial solution that settles your debt for less than the full balance owed. To figure out your best debt relief option, your first step would be to get free financial advice from an IAPDA certified debt advisor.

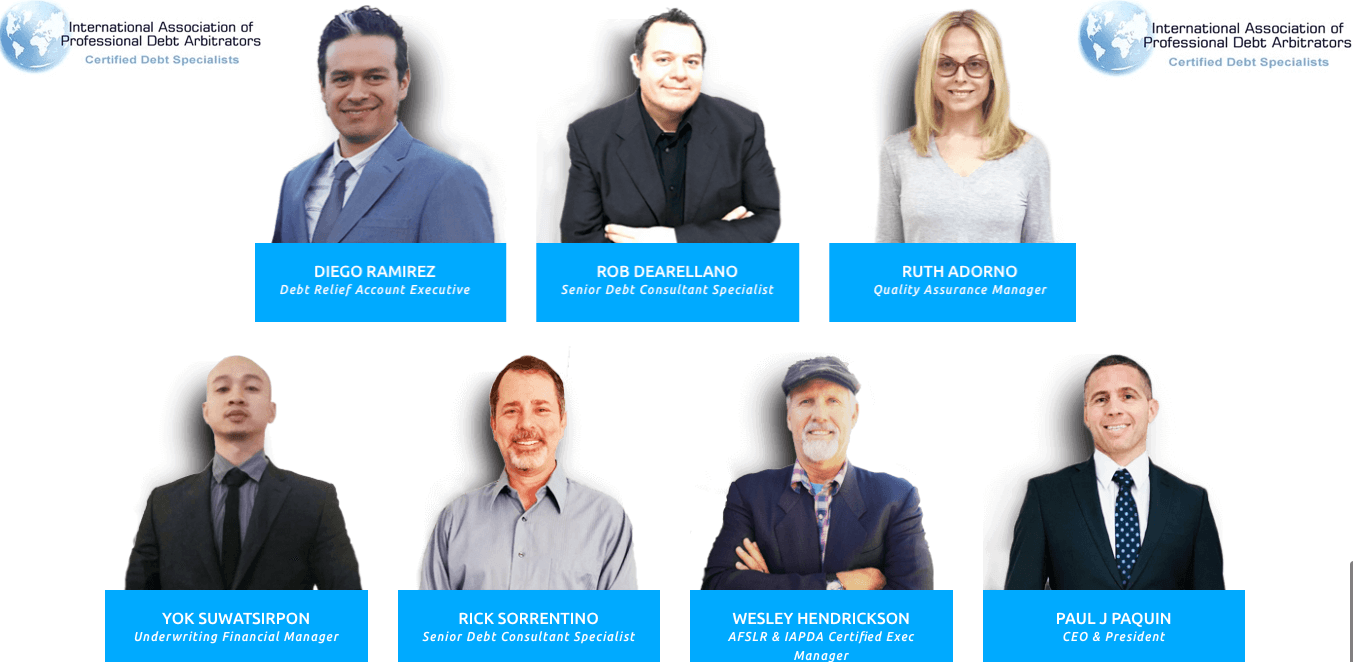

Our financial counselors are all IAPDA certified and accredited and can help you find the right financial solution for free! If you want to get out of debt on your own, without a debt relief program, you can learn the best strategies to clear your debt by visiting this page here.

Financial Debt Relief Programs

- You get one single and affordable monthly payment to take care of all unsecured debts

- You’ll know how many monthly payments are left until you’re debt free

- All interest can be eliminated and you can end up paying less than the full balance on each of your debts

- Plans come with a money back guarantee and credit repair for no extra cost

- And best of all, you can hand over all communication with your creditors to a debt relief company, and shift your focus to other priorities in life

Need a Financial Counselor or Debt Advisor?

Explore all of your debt relief options and find a path to quickly get out of debt, whether that’s debt consolidation, consumer credit counseling, debt validation or debt settlement.

Free Financial advice is a quick phone call away!

Talk to Financial Counselor & Get Free Financial Advice

Golden Financial Services – Company Credentials

- A+ Better Business Bureau Rated (click to verify)

- IAPDA Certified and Accredited (click to verify)

- 100’s of Positive Online Reviews

- Ranked #1 Rated Debt Relief Company by Trusted Company Reviews (click to verify)

Debt can be accumulated by borrowing money, unexpected expenses that come up, medical conditions and hospital bills can lead to debt. Banks giving consumers high credit limits on their credit cards and consumers using that credit unnecessarily on items that they want and not need can also lead to consumers accumulating high debt. It’s easy to accumulate debt, but not as easy to find the right financial debt solution to pay off debt.

Golden Financial Services focuses on financial debt solutions and helping consumers with being proactive about their financial situations. It’s important to first identify why consumers fell into their hardship situation or how they accumulated their debt. After identifying how consumers accumulated their debt, then it’s time to move forward finding the right financial debt solution. While assisting Americans with their financial situations, Golden Financial Services believes that education is the key to preventing consumers from falling into the same path again in the future. Financial debt solutions can help consumers to reach total debt freedom, but without education, consumers are likely to accumulate debt again in the future.

Summary of Financial Debt Solutions

Financial Solution #1 – Debt Consolidation

What are the best financial solutions? Debt consolidation, debt settlement, learning how to pay off your debt without debt consolidation? Financial solutions can range from paying off your debt on your own to using a debt relief program, depending on what your financial needs are will determine the best route. If your credit score is above 710, you can consolidate your debt into one low monthly payment by using a low-interest loan. Debt consolidation financial solutions require your credit score to be above 710. If your credit score is under 710, no credit union, bank or financial company will give you a low-interest loan.

If you can get a debt consolidation loan, you want to pay at least double your minimum payment on the new loan, or use either the debt snowball or avalanche method of paying off debt. If you only pay minimum payments you’ll end up paying the maximum amount in interest, which would defeat the purpose of debt consolidation. Financial solutions for consumers who have a high credit score are all outlined on this next page here.

There are pitfalls with debt consolidation, like with all financial debt solution programs. You will end up paying all of your debt back, plus interest, with consolidation. With the next set of options, you can pay less than the full balance on each account.

Financial Debt Solution #2 – Debt Settlement

Debt settlement or debt negotiation is the preferred financial debt solution for many consumers due to it being the fastest way to pay off their debt while saving the most amount of money.

When choosing a Debt Settlement Company it’s important to choose a company that is an IAPDA certified firm and BBB A+ Rated.

At Golden Financial Services we’ve been in business since 2004. Any complaints that we’ve ever received are at least six years old. The reason why is because over the last six years we’ve added the best debt relief programs in the nation into our program infrastructure.

The best debt settlement companies will have over a 5-year track record in the financial debt solutions industry. A company that has over a 5-year track record will likely have more experience and leverage with the creditors, than a company that has been in business for only 2 or 3 years.

2 or 3 years in business is not enough time for a debt settlement company or any financial services company to establish a proven track record due to consumer plans lasting for at least 2 to 3 years.

How many graduated clients can a company have if they’ve been in business for only 2 years? ZERO!

Debt settlement can be the most challenging financial debt solution for consumers, but also can save you more money than any other option.

- Beware of companies that quote consumers a 70%-80% reduction on a debt settlement program. Realistically, clients end up paying back about 70% of their total debt with debt negotiation services (this includes fees)

- Credit scores will be negatively affected on a debt settlement program because your creditors won’t get paid on a monthly basis, but rather in one lump sum payment.

- When you settle a debt for less than the full balance owed, the amount of debt that gets forgiven is taxable income. You can eliminate the tax liability by using the IRS Form #982.

- Not all clients will graduate a debt settlement program due to reasons such as their inability to afford the program

- Creditors can pursue legal action and issue a client a credit card summons if credit cards aren’t getting paid in full every month, but this is rare (2-4% of the cases get a summons)

Financial Debt Solutions are only a step away at Golden Financial Services. The first step to resolving your unsecured debt issues is to read and get educated. Debt Enrollment Specialists at Golden Financial Services can assist you with taking the next step and starting on the financial debt solution that is right for you.

Free Financial advice is a quick phone call away!

Talk to Financial Counselor & Get Free Financial Advice

Financial Solution #3 – Consumer Credit Counseling

- you’ll get out of debt faster and pay less interest with consumer credit counseling

- this program doesn’t lower your credit score as much as other programs can

- you only have one payment to worry about each month for all credit cards

- your creditors continue to get paid every month

- if you’re one to two months behind on payments prior to enrolling in a consumer credit counseling program, the late fees can be waived and payments re-aged to current

- only credit card debt qualifies for consumer credit counseling

- you are stuck to a 4-5 year program

- a consumer credit counseling notation will be reported on credit

- not all consumers will qualify