Best Debt Relief Options for 2023

Options for debt relief in 2023 include debt settlement, debt validation, and consumer credit counseling. In addition, a debt consolidation loan is another option. Debt consolidation loans may be suitable for people with high credit scores and steady incomes.

Your first step must be to learn about debt relief options, including their pros and cons. You can then decide your best choice for debt relief.

Second, you’ll need to find the right company for help. Debt relief companies vary in size, reputation, and abilities. Prioritize this step, don’t just sign up with the first company you find on Google. Consider the fact that you’ll be partnering with this company for up to five years and relying on them to help you get out of debt.

Rest assured, the following page explains debt relief options with pros and cons and teaches you how to find reputable providers that you can trust. Below, we use a scale from 1-10 to help you weigh the financial benefits to downsides that a debt relief service can have on your credit. This scale-like system will help you understand the asymmetrical relationship between the impact on a person’s credit score and the potential savings that can result from each debt relief program.

Ultimately, you have the power to choose which path to take to help you get out of debt and accomplish your long-term financial goals. In addition, you have different types of programs to choose from with flexible and affordable payment options. So without further ado, let’s dive in and show you the ropes!

Best Debt Relief Companies for 2023

The other important priority step is figuring out the best company to use. Don’t just do a Google Search and sign up with the company at the top of the list. Finding debt relief help is not the same as shopping for groceries or buying a new television set. Instead, you’re signing a contract for a 3-5 year partnership to help you manage your finances. Take this entire process seriously because it can be the difference between financial freedom and financial destruction.

Use a debt relief company with a successful track record, top credentials, and positive online reviews. Conversely, debt relief companies with many complaints online, lacking a proper debt management, lender, or consumer credit counseling license, and insufficient time in business should be avoided at all costs. Here’s what you need to know as you start your journey toward freedom from debt.

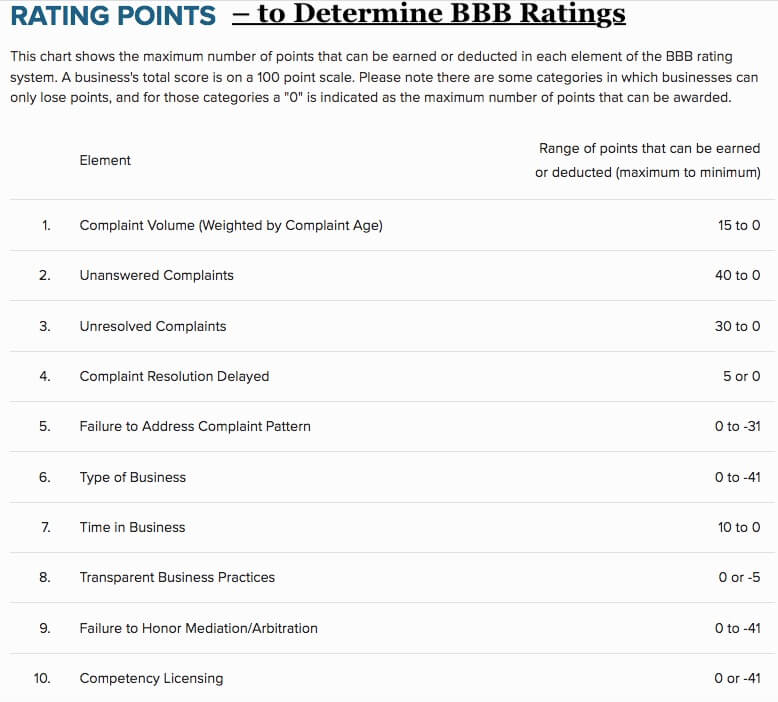

BBB Accredited Debt Relief Companies (also A+ rated)

The Better Business Bureau (BBB) takes its accreditation and rating system very seriously, requiring companies in all industries to abide by strict industry-specific regulations and laws. Additionally, as shown in the image above, BBB has a scoring system requiring companies to “earn” their rating; it’s not paid for.

For example, debt settlement companies must be licensed, have sufficient time in business, and resolve complaints in a timely manner to earn an A+ BBB rating. And just the fact that a company is licensed offers a long list of benefits. For example, licensed companies cannot charge up-front fees, must be bonded, and even pass a strict background check to get a license.

So, contacting only BBB-accredited and highly-rated companies will protect you from fraud and scams. So, start with that when searching for a company to help you with your financial situation.

Compare Debt Relief Options:

Multiple debt consolidation services are available to choose from.

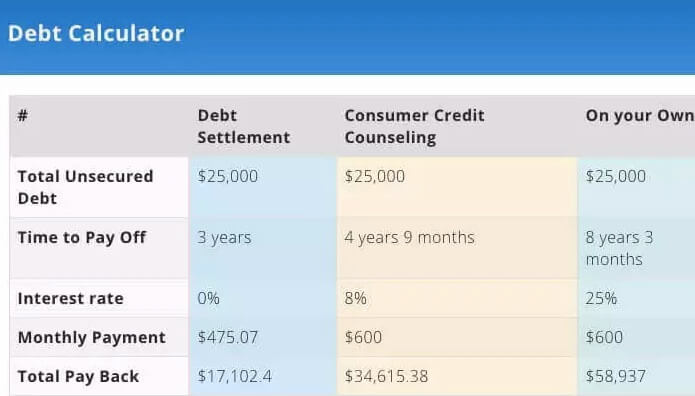

Compare credit card debt relief options based on $25K in debt:

But what’s the best option? Your best credit card debt relief option can only be determined after carefully considering your financial situation, goals, and needs. You see, each debt relief program acts entirely differently and offers specific solutions to various problems. So let’s take a closer look.

- Is your goal to eliminate debt fast, and you’re OK with a temporary negative effect on your credit?

- Are you contemplating filing for Bankruptcy over unsecured debt?

- Is debt no longer affordable for you to pay on your own due to financial hardship?

Consider Debt Settlement Services:

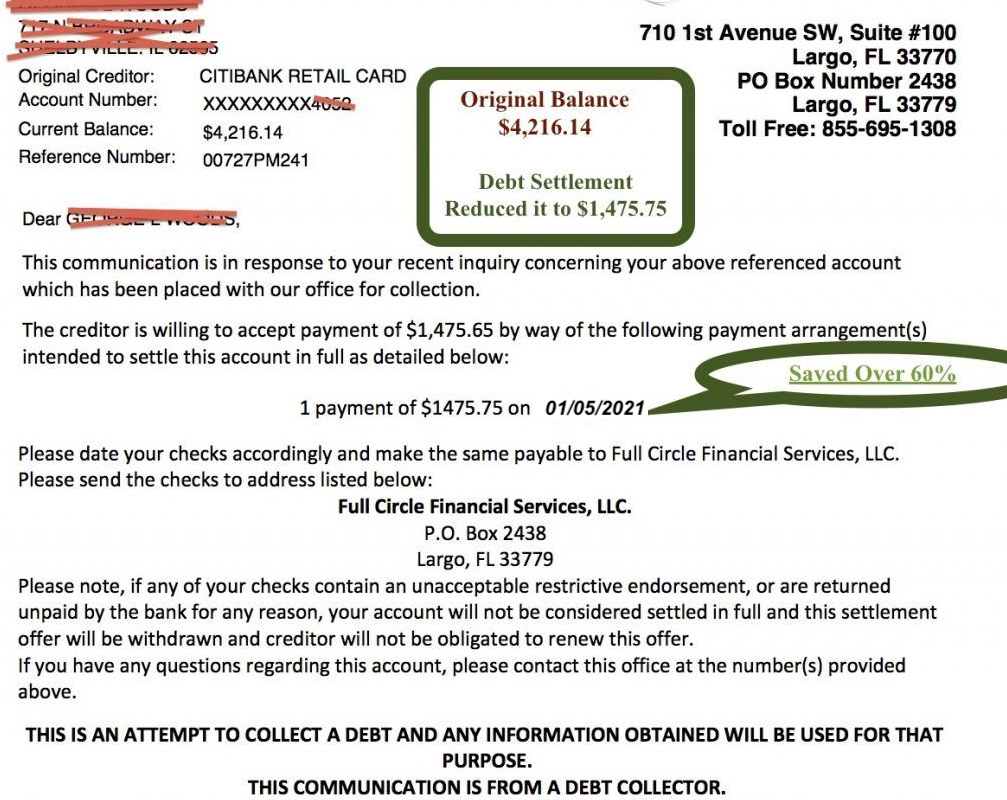

Debt settlement services may be an attractive route for you to consider. You can get debt forgiveness on a portion of your balances, making your debt affordable to pay off. And you can become debt-free in under four years on a path that offers you one low monthly payment. However, creditors don’t get paid monthly, and payments will become past due, eventually going to third-party collection status.

How debt settlement services affect credit scores:

To get a portion of your credit card balances forgiven with debt settlement, expect a negative effect on credit scores due to accounts having to fall delinquent before settlements and debt forgiveness occur.

Do debt settlement services work?

A clear understanding of a debt settlement program’s different stages and solutions to potential obstacles that may come along the way while on the plan can set you up for success. For example, you should know the first 3-6 months of the program require you to stop paying creditors, allow accounts to fall delinquent, and eventually get written off and sold to third-party collection agencies.

You need to know how to handle creditor calls and what to do with the collection letters you receive. What’s the plan if you receive a credit card summons? When should you expect your first settlement to occur? What fees are included in the program, and when will they get charged? What if you run into a problem and find yourself in a position where you can no longer afford the settlement program payments? All of this you need to understand clearly.

And if you don’t have a clear understanding of the program and its different stages, obstacles and unfriendly surprises may arise that you don’t know how to deal with, resulting in you canceling the program, getting angry, and the program not working.

Traits of the Best Debt Settlement Services:

- Charges no up-front fees: The fees should only be charged after a debt is settled. How much do the best debt relief services cost? Settlement companies will charge, on average, between 15-25% of the debt enrolled, only earned after settlements occur.

- Large customer service department. Is there a phone number you can call if you have a question or issue? Communication is key.

- Provides lots of financial education while enrolled in the program.

- Better Business Bureau A+ rated and accredited.

- International Association of Professional Debt Arbitrators (IAPDA) certified and accredited debt enrollment counselors.

- Online access to monitor your program’s activity and results 24/7.

- It is transparent about the program’s downsides, especially about potential lawsuits and how they are handled.

- Offers more benefits than “settling debt”: For example, some companies offer a loan to clients to help fund settlements and get out of debt faster. What makes the company different?

- Time in business: Companies should have at least five years in business.

- Complaints and online reviews: Check out online reviews about a debt relief company on sites like Yelp, Reddit, TrustPilot, TrustedCompanyReviews.com, Google, and BBB. Does the company have lots of complaints and negative reviews?

- The counselors are not pushy to make you sign up for their program and offer a free consultation.

- During your initial free consultation, the counselor clearly explains – 1.) the program and its different stages, 2.) potential downsides that could arise (e.g., potential lawsuits, collection calls, adverse effects on credit), and 3.) all fees and when they get charged.

- During your initial consultation, the counselor will explain all the alternatives you should consider, including credit counseling, Bankruptcy, and debt consolidation.

- Check the company’s website: Pages should provide detailed explanations about all debt resolution and credit card relief options, including the pros and cons of each. For example, suppose you’re mainly seeing positive attributes of the service and very little about the potential negatives. In that case, that’s a red flag because there are potential downsides with all options, and they should be transparently displayed for the public to know about.

Accredited Debt Relief is the Best Debt Settlement Company for 2023, According to GoldenFS.org:

After digging across the internet for reviews about debt relief service providers, I found Accredited Debt Relief is one of the best companies that check off each of the traits mentioned above. Keep in mind Golden Financial Services no longer provides these services. Our website is an informational resource for learning about debt relief, settlement, and consolidation services. You can also visit BBB.org or TrustedCompanyReviews.com to explore other top-rated settlement companies.

Is your goal to reduce interest rates on your credit cards without negatively affecting your credit score?

These questions play into the equation when determining what program to use to accomplish your goals. For example, consumer credit counseling services consolidate your credit cards into one monthly payment. Clients pay the company, which pays the creditors monthly but at a reduced interest rate.

Credit counseling companies have pre-established relationships with almost all credit card companies to reduce interest rates, making their program a reliable and safe way to save money on credit card debt.

Start with a consumer credit counseling quote. Then, consider debt settlement if you can’t afford that program or need more savings. Consumer credit counseling can help you avoid negativity on your credit, but debt settlement may be the better route if you need maximum savings.

Why debt settlement over consumer credit counseling services?

The problem related to consumer credit counseling is that people often need this service due to financial hardship and the inability to continue paying the full amounts on their credit card bills. And with consumer credit counseling, you’re paying all of your debt with interest, just less than what you’d pay on your own.

So if you’re struggling to keep up with credit card payments, consumer credit counseling often won’t be a feasible solution.

Why consumer credit counseling over debt settlement?

Of course, for some consumers, consumer credit counseling is precisely what they need. Their issue may not be a drastic reduction in income or inability to pay their debt in total, but rather high-interest rates preventing them from saving money over the long term. Their mindset may be that they need their interest rates reduced without negatively affecting their credit score, and affordability is not the issue. They realize they have steady employment and can afford to pay the monthly consumer credit counseling payment over the next five years.

Debt Relief Services Resources for 2023

- Learn more about BBB-accredited debt settlement and credit card consolidation companies

- Read the 10 Best Ways to Clear High Credit Card Debt

- Visit the Department of Justice’s website for a list of non-profit consumer credit counseling companies by state

Traits of the Best Consumer Credit Counseling Companies:

- They are willing to send free information about their company and services without you having to provide your personal details.

- Offers free financial education.

- Included, you’ll get budget counseling and savings and debt management classes.

- Over five years in business, preferably ten or more.

- Offers in-person counseling upon request.

- Is Licensed in your state for Consumer Credit Counseling Agencies Approved under 11 U.S.C.§ 111. Their company and website should be listed as a licensed and approved agency at the Department of Justice.

- How much do top consumer credit counseling services charge? Charges an enrollment fee of $75 or less and monthly fees adding up to no more than $50 per month.

- Mostly positive reviews online at BBB, Yelp, and Google.

- Includes a Money-Back Guarantee.

What factor makes one debt relief service better than another?

The best debt relief services have large outstanding customer service departments. And you can find this out by searching for reviews online about the company. If their customer service is extensive and exceptional, you can be assured you’ll find hundreds of reviews online about them online (and most should be positive). This is a massive benefit of the internet; it’s easy to research any company you’re considering doing business with.

Debt relief services require a sufficient number of customer service representatives and departments to be in place to be successful. Dealing with a person’s financial situation can be a complex subject that only the most reputable companies seem to do right.

What type of debt is eligible for a consumer debt relief program?

- Credit card bills (Payday loan debt relief services also available)

- Store and gas card bills

- Medical bills

- Utility bills

- Private Student Loans

- Unsecured personal loans

- Car Repossessions

Debt Settlement Relief

A debt settlement service can reduce your unsecured debt balances to a fraction of what’s owed. In addition, you will only have to pay one monthly payment.

Your monthly payments accumulate in a trust account (also known as a special savings account). Clients get notified only when enough money is available in that account and a creditor agrees to an attractive settlement offer.

After a client agrees to a settlement offer, everything is finalized in writing. One reduced lump sum payment will then be released from the client’s program account and paid directly to the creditor — resulting in a “zero dollar balance” and reported as “settled in full” – and sometimes removed from the client’s credit report entirely.

How fast can you get out of debt with a debt relief service?

Clients can speed up a debt settlement program by putting extra funds into their debt settlement trust account on top of their scheduled payments. In addition, there are no pre-payment penalties of any kind. Some companies, like Accredited Debt Relief, even offer clients loans after making at least three monthly payments. The loan is used to fund settlements and help clients get out of debt even faster. As a result, clients can graduate from a debt settlement service as quickly as 12-18 months.

Clients notify a customer service department representative that they have extra money for the program and deposit the funds when they want to pay extra. The debt negotiators will then pick up the pace and aggressively negotiate.

Clients have total control over their program — while the debt negotiators do the fun part — negotiating with debt collectors. Learn more about debt settlement next.

Debt Validation as a Debt Relief Service

Some consumers will qualify for a program called debt validation. With debt validation, a third-party debt collection account can be disputed. The collection company is forced to prove a debt is verifiable and legally collectible. You may not have to pay if they can’t prove it’s valid.

Unfortunately, enrolling in a program like this over valid credit card debt is not advisable. You will likely resort to settlement services after certain accounts fail to get invalidated, costing you more money and time than if you’d started with settlement services in the first place.

Learn about debt validation next.

How does debt consolidation work?

Debt consolidation is a loan to pay off other debt. The point of debt consolidation is to eliminate high-interest accounts.

It’s effortless.

- Apply for a loan

- Once approved — use the low-interest loan to pay off your high-interest accounts.

- I am leaving you with one low-interest loan to pay back.

Credit Card Debt Relief Service Disclosures

- With debt settlement services, your creditors will not get paid every month but instead in lump sum payments at the time when settlements occur. Consequently, late fees and interest could increase your balances while enrolled in a debt negotiation or settlement program. However, at the time of a settlement, the excellent and late fees are included in the final negotiated settlement, leaving you with a zero-dollar balance once the payment is funded.

- Your credit score will most likely be negatively impacted while enrolled in a debt settlement program due to creditors not getting paid monthly.

- Debt reduction programs do include fees. For example, you could pay approximately 70-75% of your total debt, including company fees, with a settlement program. Be sure to review the total cost of a debt relief service. Understand what money is paid to the creditor and how the fees are collected to ensure you understand the total cost.

- The savings could be reported as income when settlements occur while enrolled in a debt settlement/negotiation program. However, if this happens, past clients will fill out the #982 IRS form to show they are insolvent.

- Creditors can sue a person while enrolled in a debt settlement program. Ensure the program has a lawsuit defense or a plan to resolve a summons and make sure the company explains this to you.

- Not all states offer the same plans. For example, California’s debt relief programs are different from Wisconsin’s. In addition, states like Wisconsin have limited debt relief options due to strict licensing requirements.

- There is no guarantee that creditors will settle for a certain percentage or that any program can remove derogatory information from your credit report. Therefore, debt relief services cannot guarantee results such as these.

What is the best debt relief option? (watch video)

How debt relief services affect credit scores:

Think about debt relief on a scale from one to ten as a way of figuring out your ideal reward (i.e., savings)-to-risk (i.e., adverse effect on credit scores)-ratio. Or, in other words, how much potential damage are you willing to take on your credit for the maximum savings?

- “1” is the least savings and minimal adverse effect on credit (i.e., paying minimum payments on your own)

- “10” is the maximum savings and most negative impact on credit (Chapter 7 Bankruptcy)

1 out of 10: Paying the Minimum Payments on Credit Cards

If you need debt relief due to financial hardship, your first response could be to pay minimum payments on your credit cards.

This option could be around a “one” on a scale from one to ten. When paying the minimum payments on credit cards, your payments get reduced. However, you’re not saving any money.

A 4 out of 10: Consumer Credit Counseling

If we move up the scale to around a three or four, it is consumer credit counseling. Again, interest rates can get reduced on this type of plan, getting you out of debt in around five years and allowing you to save money on interest with minimal damage to credit scores.

A 7 out of 10: Debt Settlement

Moving up the scale to around seven is debt settlement. You’ll pay less than the total balance on each debt enrolled, resulting in a portion of the debt getting forgiven. However, credit scores will be more negatively affected than with consumer credit counseling.

10 out of 10: Chapter 7 Bankruptcy

And lastly, think of Chapter 7 bankruptcy as a ten, with the best savings but the worst damage to credit scores and credit reports. Your debt could get eliminated in under six months, and all you’ll pay is the attorney fees. But, unfortunately, your credit report will be negatively affected, with BK showing up on it for the next seven to ten years, potentially even having an effect on future employment and being able to rent a home.

So figure out on this scale from 1-10 where you want to be, based on your need for debt relief and balanced with your desire to keep a high credit score.

Final considerations:

Suppose you’re enrolled with a reputable debt relief company. In that case, they’ll provide you with financial education while on the plan, helping you prepare to rebuild your credit even stronger than what it is today over the long term. The best debt relief service providers do more than settle debt. They help you prepare for a better future financially, teaching you valuable lessons to help you stay out of debt after finishing the program.